Happy May everyone! As we say “Goodbye!” to Spring, and “Hello!” to Summer, the market had a mixed bag of good news and not-so good news to report in April. Let’s break down some stats and see if we can see any trends building as we head into the (traditionally) busier Summer months. [Read more…] about A Mixed Bag of Market News for April

market stats

Experts Still Say Year is Moving Strong! 💪

Aloha Everyone, hope 2017 is moving along! It feels like the sun is finally starting to shine in Hawai‘i, and it’s a welcome respite after some torrential rains this Winter. On the Real Estate front, the market continues to have low inventory numbers, while median prices rise. Let’s take a look at some specifics and see what February looked like. [Read more…] about Experts Still Say Year is Moving Strong! 💪

Will the Rooster Bring New Changes in 2017?! 🐓

Aloha Everyone, and Gong Xi Fa Cai/Gong Hey Fat Choy!

The Year of the Rooster is here, and 2017 is off to a rocket start! Agents in the office are beginning to settle back into their normal routines after the closing of 801 South Building B, and all of us recover from the seemingly-endless supply of parties over the holidays. It’s shaping up to be an interesting year, both inside and outside of the real estate market, so let’s take a look at how 2017 started…

The biggest news for the month was the record-low inventory in the marketplace. The statistic that we use is to figure out the health of the inventory supply is”Months of Inventory,” or how long it would take to sell every home available. In January, that number dropped to 2.4 months, meaning that if no new listings came on the market, we would be completely sold out in by mid-April. That’s a super-low number, and unhealthy for a balanced market. As the inventory stays low, Buyers will continue to compete over the few good listings out there, and Sellers with good properties will continue to see multiple offers.

As for sales numbers, the number of condos and homes sold in January were up over last year’s numbers, while median prices rose and dropped for condos and homes, respectively. Median condo prices are up to $380,000, while homes dropped slightly to $730,000. Nothing dramatic to write home about, but I will keep watching both of those numbers as they’ve seemed to slow slightly in their annual growth (realtive to last year’s big growth).

The overall financial market is still adjusting with President Trump now sworn in. Mortgage prices have bounced up above 4%, and the fed continues to keep an eye on inflation. Overall, it looks like people are going to be more cautious, and a Rooster in the zodiac supports that (if you believe in that sort of thing 😀 ).

Anyway,if you haven’t heard it enough already…

Happy Chinese New Year! Hopefully you all ate good dim sum and will have long lives! If you need anything, you know where to find me!

ALOHA!

Nick

Happy New Year! Time to Reflect on 2016 & Look Ahead!

Happy New Year! I’m going to sound like a spoiled kid, but I can’t wrap my head around this fact: the 2017 Punahou graduating class was two when I graduated high school! I was a senior in High School when Dallas Cowboys running back Ezekiel Elliot started Kindergarten…WHAT!?! I can’t believe that it’s 2017 already, and I can’t believe what a year 2016 was! Let’s recap some stats! [Read more…] about Happy New Year! Time to Reflect on 2016 & Look Ahead!

Ho! Ho! Hoooomes Continue Up! How Far Can This Trend Go?!

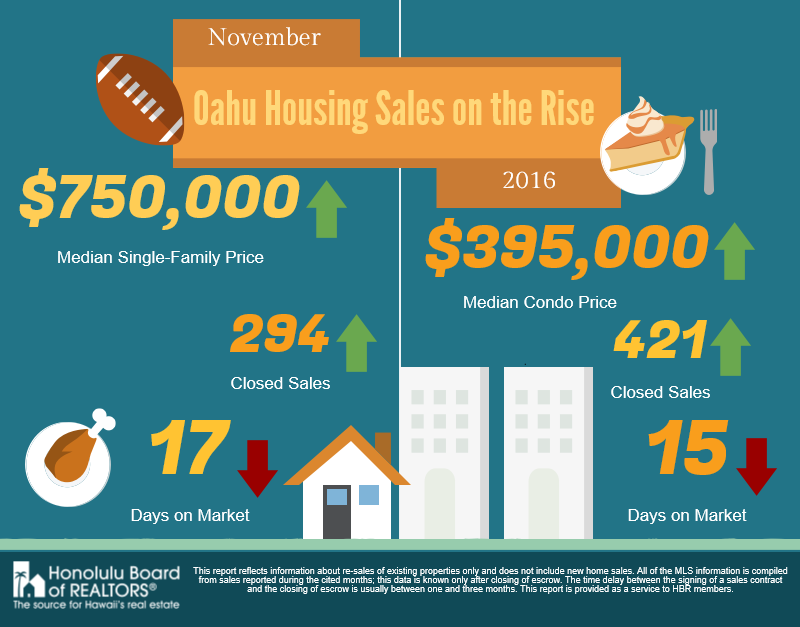

Happy holidays everyone! I hope you are finding yourself happy & healthy as we enter the end of 2016 and into 2017! I can’t believe this is my last post for 2016 already…these years fly by! Speaking of flying, November stats continue to show a “flying” real estate market here on the island, and it doesn’t look like it’s slowing down heading into December. Let’s take a look at the numbers…

Yup, median prices are up, closed sales are up, and days on market are down. All signs continue to point to a strong Seller’s market, as inventory continues to fall. Some of the biggest changes occurred in the number of closed sales with both homes and condos up 19.5% and 17.6% respectively, over last year. We continue the trend in 2016 with more properties selling than coming on the market.

Condos also showed a 13.7% jump in median price over last year, while single-family homes rose 4.8%. In dollars, that’s roughly a $34,000 jump in homes and $48,000 in condos. I think the rise, especially in condos is due to more higher-priced units selling (due to the lack of inventory). The average sales price of condos sold rose 11.4%, which further enforces my feeling.

So what’s in store for December and heading into 2017? Well, it’s pretty obvious that low inventories continue to drive a competitive market here on O‘ahu. Properties are also selling faster despite the holiday season approaching, indicating that Buyers are still aggressively shopping in the market. It doesn’t seem like it’s slowing down any time soon!

I’ll continue to monitor the numbers, especially as President-elect Trump takes office. The Fed has already indicated a rise in bank rates next week, and possibly again through 2017 to offset inflation. Most experts are indicating a rise in mortgage rates to the mid-four percent range, so if you’re on the fence to purchase something, this may be a better time than waiting!

Have a good finish to 2016, and I hope you have a great start to 2017!

ALOHA!

Nick

The Market is Gobble-Gobble-Gobbling Homes!

Hi Guys & Gals, I hope your holidays are kicking into gear and 2016 is finishing strong! The Kawakamis are all preparing for a busy season, and it seems that the market is following suit!

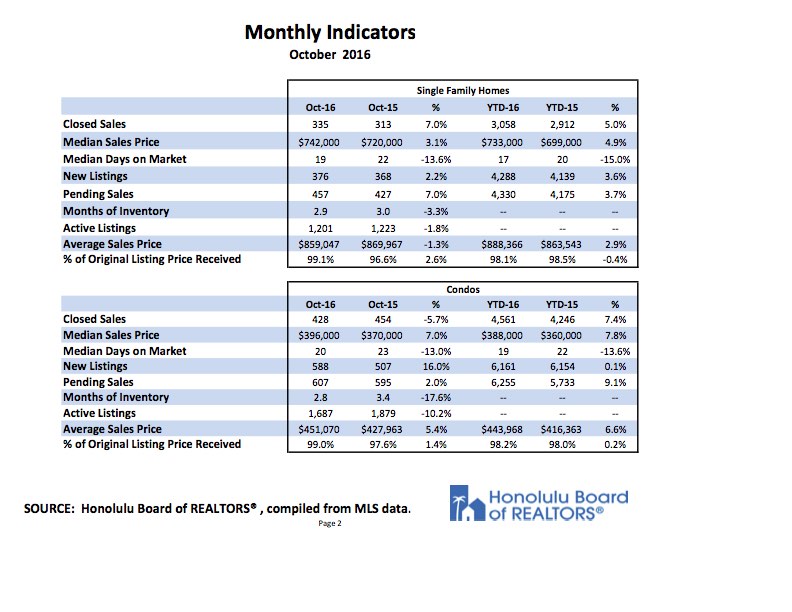

Homes, both house and condo, continue to fly off the market as inventories continue to drop and days-on-market fall. Median prices for condominiums increased by 7% over last year to $396,000, while single-family homes increased by 3.1% to $742,000. Days-on-market, the statistic that accounts for how long an available home sits on the market, dropped to 19 days for single-family homes and 20 days for condominiums. Considering these stats include the finicky multi-million dollar listings, it’s a really strong indication that things fly quickly!

So what does this mean for my clients, especially as we head into the traditionally-slower winter months? If you’re thinking about selling, there are still plenty of Buyers looking for a home. It’s my opinion that the shortage of housing throughout the summer months will give us a good group of healthy Buyers for the foreseeable future. For my clients looking to buy, there are still a lot of great opportunities, especially with these low interest rates. If you’re even considering purchasing something in the next couple of years, keep an eye on those interest rates! With a new president coming into power, and an sensitive bond market, it will be interesting to see how rates react.

Happy Thanksgiving everyone! Looking towards to the end of the year, I hope everyone has a safe holiday season!

Nick

Home sales flatten, but condos still ablaze! 🔥🔥👍

Happy October Everyone, and happy beginning-of-holiday-parties season! It’s crazy to think we are here already, and I hope you are all gearing up for Halloween and other fun things as we close out 2016! The stats for September 2016 are out, and here’s my take on the local market…

Single-family homes saw a stall in growth versus last year, as the number of closed sales remained the same. It’ll be interesting to watch this number as we end the year, and see if the trends continue “normal.” We did see a slight bump in median prices versus last year, but it remains inline with the growth of the overall year. The “outlier stat” for September single-family homes was the days-on-market (DOM), which has remained at 16 days for the third straight month. Usually in September, we start to see a little longer DOM, but not this year!

As for condos, number of sales climbed for the third month in a row and rose 6.7% versus last year. It’s hard to predict where condos will go month-by-month, because their production is so heavily tied to market factors and the products vary so greatly. In fact, median price is down versus last month, while last September saw a bump versus that August. DOM are back up to 20, and look for that to shorten again as less new inventory came on the market.

Like I said, it will be interesting to see how the year will fill out. There some factors that seem to follow market trends, and some that don’t. I’m also going to be watching the election results to see if that has any affect on our little island home as well!

Happy Halloween everyone, and a quick note of love to my friends and family in Florida! Hurricane Matthew sucks, but we are here if you need us!