Homes Down & Up, Condos Up & Down. HUH?!?

Hi Everyone, it looks like some rain has started the fall season! It’s been a welcome change on our end, especially after the super-hot summer we had! Plus, I’m enjoying all the well-watered, green mountains too! It was an interesting month in the Oahu real estate market, so let’s see what kind of trends we saw in September…

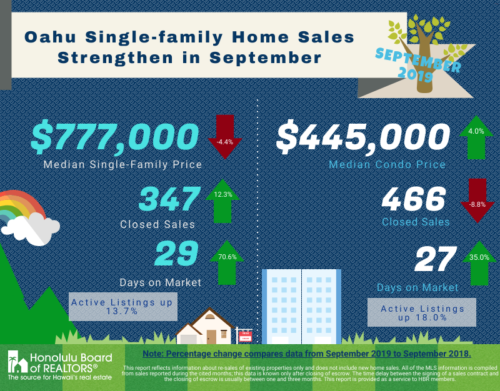

Single-family home prices down 4.4%, and condos up 4.0% YOY in September

Despite a second fed rate drop, single-family homes on the island dropped 4.4% on their median price in September vs. last year. Condos, on the other hand, have seen a 4.0% increase in median price using that same timeframe. As I’ve been saying throughout the year, we’re seeing a leveling market, so these minor changes are not anything to be surprised by. What is very apparent this year is that trying to predict which side of the market will be up or down is seemingly impossible.

Are the Feds planning another rate drop?

There have been rumors online that the Fed is planning another rate drop, as early as this month. As I understand it, they are still seeing signs that point to a slowing economy, and are hoping these rate drops will help prevent a sudden and drastic recession.

The weak producer inflation readings reported by the Labor Department on Tuesday came against the backdrop of a slowing economy amid trade tensions and cooling growth overseas. The Trump administration’s 15-month trade war with China has eroded business investment and pushed manufacturing into recession.

Weak U.S. producer inflation bolsters case for Fed rate cut – Reuters.com

To be fair, their rate drops have been intended to stabilize the market, not spur a mid-2016 buyer’s market. And so far, it seems that our local housing market has seen that result. However, it has been a KABOOM for the refinancing market, with lenders reporting jumps each time the fed cuts rates.

Prepare yourself for a month-average on the market

With all my new listings, I have prepared my clients for higher days-on-market counts as inventory numbers rise. This advice should not be misunderstood as a sign of a buyer’s market, but more along the lines of a picky-buyer’s market. There doesn’t seem to be any decrease in the number of buyers in the market, but there does seem to be less of a rush on the buyer’s side. The days of 12-day-averages on market are gone, so just be patient and we’ll get there soon!

Leave a Reply