Summer is here and boy is it a hot one (literally)! I don’t know about all of you, but I’m on the hunt for good A/C wherever I go. In fact, maybe I’ll only take listings that have A/C this summer (just kidding)!! The market overall seems to be heading as expected, as more inventory comes on and prices still rise. Let’s take a look at some stats and see what we can decipher.

Median prices continue their bumpy trend, with condos rising slightly higher than expected

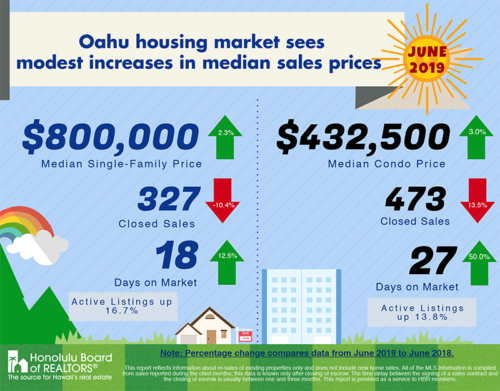

As I mentioned last month, I expected the rest of the year to see median prices bounce between -2% and +2% changes versus last year. Homes continued that trend, bouncing up 2.3%, to $800,000, while Condos rose higher than I expected, jumping 3.0% to $432,500. I still expect those bumpy numbers for the rest of the year.

Buyers still seeking same range of pricing, despite rise in median price.

One big reason I expect a positive growth throughout 2019 is because the majority of Buyers are still seeking the same price range as 2018. According to the stats from June 2018, the majority of Buyers bought homes in the range of $600,000 to $1,000,000 (218 of 365 total homes sold, or 60% of the market share). The majority of condos sold were between $300,000 and $600,000 (317 of 547, or 58%). Looking at June 2019, we see almost the same percentages in those same price ranges. Homes in their price range made up 199 of 327 total homes sold, or 61%, while condos sold 278 of 473 or 59%. That’s a 1% difference between the two years, pointing to a similar need in the housing market.

Inventory up in price ranges that matter

Finally this month, let’s look at where the inventory is growing and how that matters. Using the same range that we used to find the bulk of home purchases, supply shows good growth for single-family homes. Versus 2018, homes priced between $550,000 and $1,100,000 (don’t ask me why they use different ranges here, it’s frustrating for me too), grew from 728 (2018) to 885 (2019), or a 22% increase. The easiest conclusion is that there are just less Buyers in the market, overall, but I think it could be a sign that there are a lot more “upgraders” in the market. Meaning there are people who are trying to sell in the meat of the market range, hoping to upgrade to something higher. We see the same trend in the middle of the condo market as well, which could signal the same deal on that end of the market too.

Leave a Reply