May shows signs of “summer heat” as the market continues to suffer from inventory and interest rate concerns. Let’s take a look at the market statistics for May and see what conclusions we can draw!

Median price slightly below record

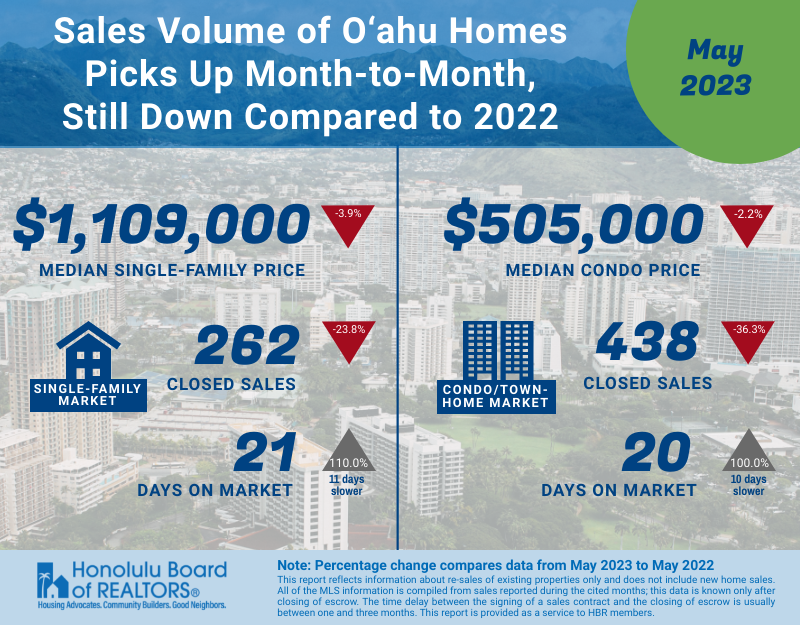

As the year has moved along, we’ve seen a bumpy trend emerge from the median price stats. Last month, single family homes dipped under $1M as “possible crash” rumblings heated up. Last month, however, showed how unpredictable this market is, as prices toped $1.1M and were only 3.9% below the historical record set May last year. Condos also got a small bump month-over month, as they stayed steady above $500K.

Number of sales still slow

Higher prices don’t necessarily mean more sales though, as single-family homes were down 23.8%, and condos down 36.3%, both compared to this same time last year. Unfortunately, with new listings also down double-digits versus last year, expect to see the number of closings stay stagnant as buyers have less new options to choose from.

Mortgage rate settling

The average long-term mortgage rate seems to be settling below 7%, giving buyers some much-needed stability in their calculations. It’s only slightly higher than last year, going from 5.23% in May 2022 to 6.71% last week, but it’s not climbing at the pace it was a year ago. Buyers should feel much more confident when making decisions now, and we should start to see that reflecting in the market.

Comparisons getting tighter

One thing I noticed in a lot of individual stats this month was how the percentage differences year-over-year are shrinking. In May of 2022, we started to really feel the effects of rate bumps, as the fed tried to quickly quell inflation. As the year goes on and we continue to compare to the second half of 2022, we should continue to see these differences shrink which may change the overall conversation in the market. The fire sale that the end of 2021/beginning of 2022 is becoming less and less a part of our market, especially as we translate to the end of the year.

Leave a Reply