Settling in to summer, July stats stay constant

Holy smokes, did summer ever come fast and the heat is here! Meanwhile, in the real estate market, the hot market continues as prices remain high and inventories remain tight! We are starting to see some signs of a lighter strain, but we are far from balanced. Let’s see what the stats actually say and see what the rest of the year has in store!

Condos prices continue to blaze

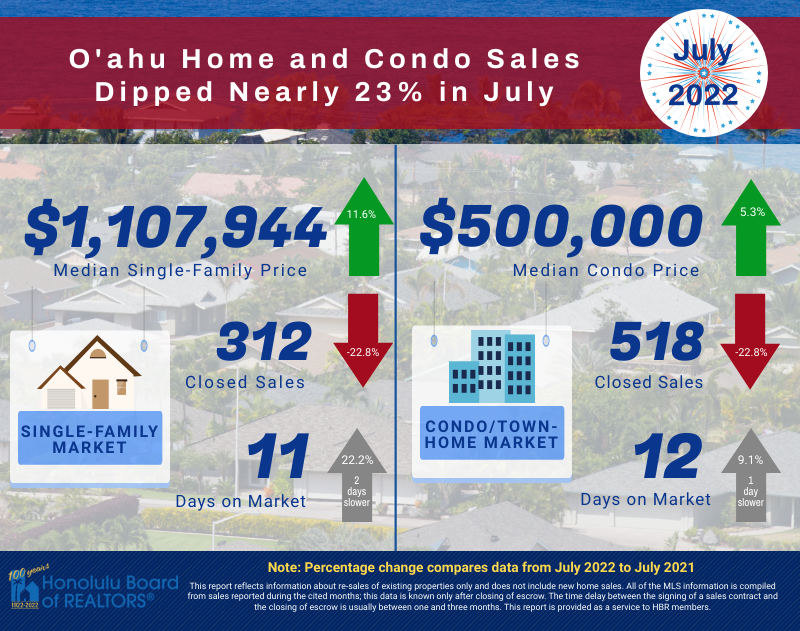

Look at those main stats above! Prices are up over 2021, number of sales are down over 20%, and days on market jump an extra day. It’s a very interesting set of stats as the basic law of economics seems to be on it’s head. Demand and pricing are still up over last year, while supply rises and number of sales drops.

Median price seems to have steadied

For the sixth month in a row, prices have steadied, with homes hovering around $1,100,000 and condos around $500,000. It’s somewhat of a relief as the past two years have seen constant increases in median prices during the post-lockdown phase of our current pandemic. On the mainland, many markets are actually seeing significant price drops but our local market has usually weathered “slower” markets with plateauing prices. If this trend continues, it could be our Hawai‘i way of seeing a more buyer-friendly market on the horizon.

More active inventory for Buyers

Speaking of Buyers, the outlook is looking better as our Months Supply of Active Inventory statistic rose for single-family homes by 45% over last month. That means that there is more active inventory in the market and any increase could mean that buyers will have more choices towards the end of the year. Like my last article mentioned, I don’t think this is going to ease pricing but it could be a good opportunity for buyers to get into a home before any further mortgage rate increases.

Back to school!

As we close out summer and welcome in the start of another school year, there are a lot of questions on the horizon for our island, country, and planet. The biggest pressure on our market seems to be the rate of inflation as Buyers grapple with rising living costs, eating away at their monthly budget. This could lead to some fluctuation in mortgage rates towards the end of the year, so keep an eye on those rates and let me know if you need any help!

Take care, and see you next month!

Nick

Leave a Reply