It’s the month of love, but has our real estate year kicked off with the same feeling? With January in the books, let’s take a look at the overall island market to see what the data is showing us and see if there are any trends we can see early in the year!

Stats for stats sake

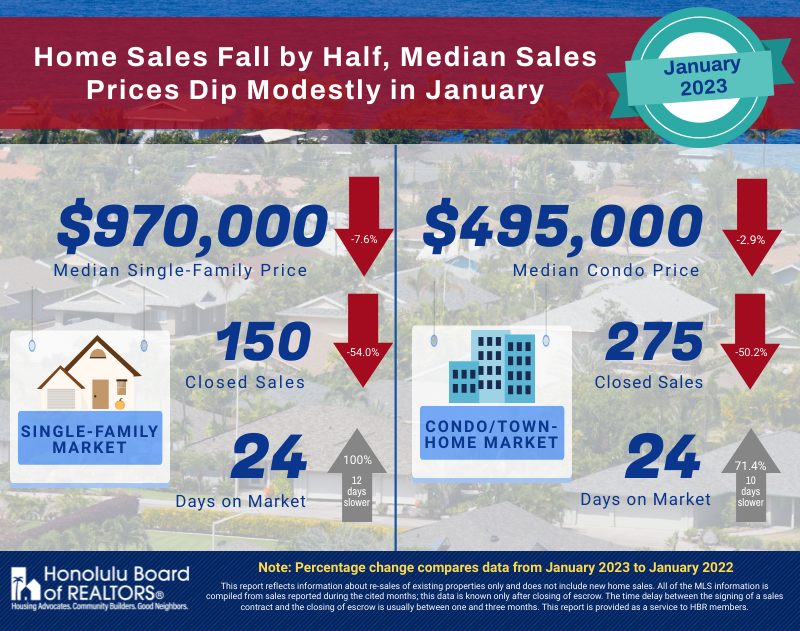

You can’t deny that seeing falling numbers versus last year is not something that prospective property Sellers want to see. With both the median price of single-family homes and condos falling 7.6% and 2.9% over the same time last year, and the number of closed down about 50% for each as well, the market did feel the slow down most predicted over the holiday season. These numbers are not surprising as rising interest rates hit recent highs as well, combining both a slower Buyer season and tougher sales prospects.

Stats versus last year

The headlines from this latest release of sales statistics highlight the large downturn in number of sales and median price. However, be careful trying to read too much into these as they are compared to a very different January in 2022. Rates were half of what they are today, Buyers were offering extreme incentives in their offers, and competition was way higher. The danger in how we compare these two different selling markets is that we sometimes place value on one over the other. Homes are still selling in today’s market, so don’t think the sky is falling just yet.

Inflation indicates no slowing down next month

The federal reserve is doing its best to slow down the economy and curb inflation. In doing so, mortgage rates have climbed higher and higher compared to this time last year. While there is some signs inflation is slowing, it doesn’t seem to be exactly where the fed wants it to be and they expect some further rate hikes coming soon. If consumer mortgage rates continue to rise over the next few months, we will continue to see fewer sales and possibly further softening of median prices. I still don’t expect to see the type of market retraction that you see in other real estate markets around the country, but it is inevitable that higher rates = higher borrowing costs for buyers = less buyers can afford = downward pressure on median home prices. Exactly what the fed wants to see, but might be tough for prospective Seller’s who think they can still list high like last year.

That’s all I have for this month, see you next month!

Nick

Leave a Reply