Spring is March-ing along, and while the stats will show another sluggish month in our local real estate industry, the market mood has much more “spring” to it! Let’s take a look at the stats from last month try to interpret this VERY interesting market.

What the stats say

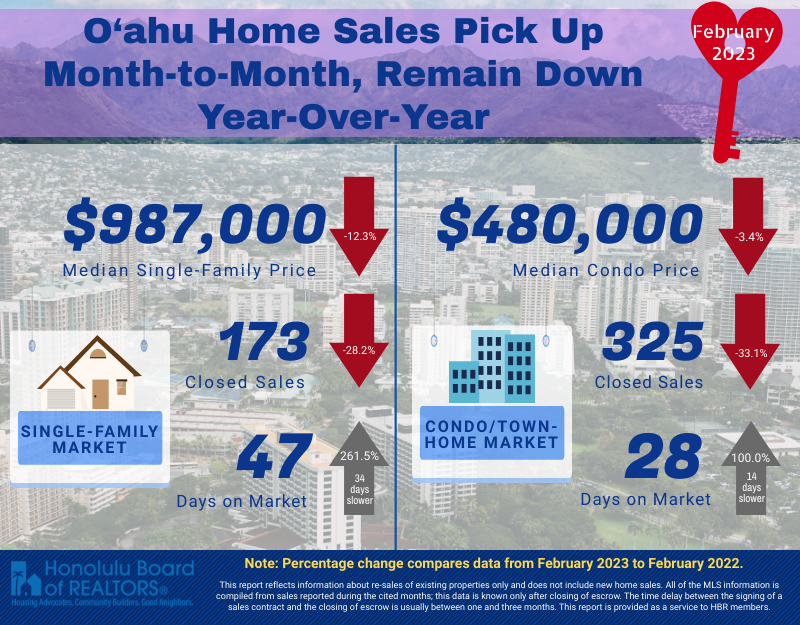

While single-family home prices rose over last month, they were down again versus last year. As mentioned last month, the market in the beginning of 2022 was on fire, so comparing the two years is “apples and oranges.” The most interesting number though was the number of days that homes are sitting for sale before they go into Escrow. That number shot up to 47 days on average last month, which is timing we haven’t seen since the condo market at the beginning of the pandemic. This should be an anomaly more than a trend, as inventory numbers shrunk versus last month. In the condo market, sales were up almost 20% versus last month but are down 33.1% year-over year. Prices are only down 3.4% versus February 2022, dropping slightly more than expected.

Interest rates rise

As the fed continues to raise the federal funds rate, mortgage rates struggle to stay below 7% nationwide. As the inflation numbers slowed during January, there was hope that would ease rate hikes, but not enough has been done to cool market activity. In the real estate industry, this has placed a lot of pressure on homebuyers, some of whom have lost 40% of their buying power versus the rates last year. You can see it reflected in the length of time on the market and plateauing median prices, as financed-backed buyers struggle to either recalibrate their expectations or exit the market entirely.

How interest rates affect Sellers

Buyers are not the only ones making decisions based on the rising interest rates. Home sellers are also adjusting their expectations because of this same pressure on Buyers. Less properties are being listed overall, as Sellers question the efficiency of the market they’d possibly be entering now. Some sellers are also feeling like they’ve “lost money,” comparing their situation to the market we had last year. Whatever their personal reason is, it’s continuing the drop in new listings on the market, tightening the little options that buyers have.

Leave a Reply