April showers bring a timid start to the summer shopping season

Let’s take a look at what the stats revealed last month and see what trends we might see throughout the hotter months of the year!

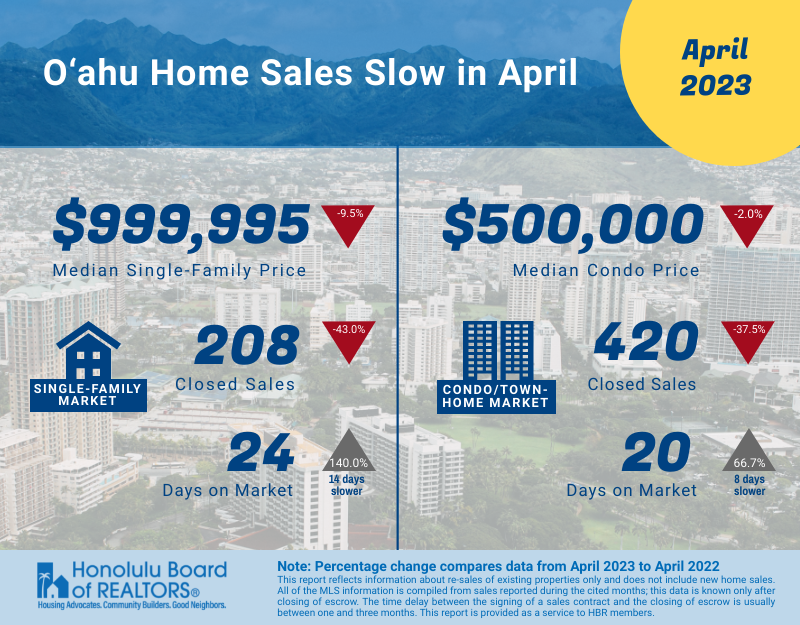

Median price back down below $1M

The bumpy year continues as the median price for single-family homes continues to bounce around the $1-million mark. As red hot as 2022 was, April was one of the last months to see huge growth as rate pressure began to kick in. Showing a 9.5% drop versus the same month in 2022 is significant, but expect to see that percentage drop as we move forward throughout the year.

March momentum softens

During last month’s market report, there were signs that rate stabilization could finally be giving buyers enough confidence to come back into the market. However, closed sales are back down from both last month and last year, signaling that momentum may not be a full trend.

Active inventory stays steady

Active inventory also remained high this month, and I think it’s safe to say that the rate hikes have affected this number the greatest. During last year’s crazy market, investors were able to get preferred financing for all kinds of properties. With the current financing market, investors are having a harder time purchasing fringe properties, causing more properties to be in inventory and this number remaining high. I’d expect this to continue throughout the year unless other factors change.

Changing year over year comparisons coming

Moving forward for the remainder of the year, it will be interesting to continue comparing year-over-year differences from 2022. At this time last year, we started to see rate hikes affect the real estate market and softer numbers finished out the year. If we continue to see the same type of markets we’ve seen so far to start the year, I expect the difference between the two years to start to dwindle.

Leave a Reply